[Nov 30, 2012] Or the rationale for the naming and the existence of this blog.

With HAIPAD I7 IPS 1024*600 Multitouch Screen with Android 4.0 Dual Camera 1080P HDMI [Merimobiles.com, Sept 10, 2012] available for $99.99 with free shipping worldwide we have a new disruption on the tablet market which has historical significance, and as such it is the manifestation of a new strategic inflection point not only for the tablet market but for the ICT industry as a whole:

- It is a commercial achievement of the once non-commercial goal of OLPC’s $100 computer.

- It is close to the current entry-level Apple product, the iPad mini costing at least $299.99 ($329 at the Apple Store):

– an IPS display of 7-inch vs. 7.9-inch;

– a resolution of 1024*600 vs. 1024*768;

– a SoC with a single core ARM Cortex-A8 CPU @1.2GHz and a quad-core Mali-400 MP GPU (9.9 GFLOPS) vs. a SoC with a dual-core ARM Cortex-A9 MPCore CPU @1GHz and a dual-core PowerVR SGX543MP2 GPU (16 GFLOPS);

etc. - It has much more parity with the current entry-level Samsung product, the Samsung Galaxy Tab 2 7.0 (WiFi) 8GB costing now $179.99 but earlier introduced for $249.99:

– 7” WSVGA(1024×600) PLS TFT display, where PLS stands for Plane to Line Switching, the Samsung equivalent of the IPS technology championed by its rival LG;

– SoC with a dual-core ARM Cortex-A9 MPCore CPU @1GHz and a quad-core Mali-400 MP GPU (9.9 GFLOPS);

– 2MP main (rear) camera on HAIPAD i7 vs. a 3MP one on the Samsung;

– 0.3MP front camera for video call on both;

– the same 1GB RAM and 8GB ROM (Flash) memory as the HAIPAD I7;

– the same Android 4.0 as the HAIPAD I7;

etc. - But the Allwinner A10 SoC in the HAIPAD I7 is beating all those entry-level products of the 1st tier brands and even higher level offerings with its inherent super HD 2160p (4K UHDTV, also called Quad HD) video decoding capability vs. the 1080p (full HD) capability of almost all other SoCs on the market (albeit the HAIPAD I7 is utilizing only 1080p out of that, but offering that via an HDMI output as well, unlike the other SoCs). Since the A10 SoC is built using a 55nm technology and this video capability (CedarX) is the IP of Allwinner, the company will have a significant competitive advantage in long term as well. (Note that Intel is preparing a 4K capability on its upcoming Haswell SoCs produced by 22nm technology, while Qualcomm has only 1080p even on its next-generation 28nm Snapdragon S4 class SoCs.) With current A10 the company foresees 2160p opportunities for tablet applications and for vehicle multimedia center applications.

- When the upcoming Allwinner

A30A20/A31 SoCs (officially not yet announcedAllwinner A31 SoC is here with products and the A20 SoC, its A10 pin-compatible dual-core is coming in February 2013 [Dec 10-20, 2012]) will be available in the products of 2013 as widely as the A10/A13 ones this year the company will have similar competitive advantage in CPUs (quadcore ARM Cortex-A7 MPCore) and in GPUs (eight-core PowerVR SGX544MP8) as well. Since theA30A20/A31 SoCs are built using 28nm technology their price will not be much higher than the current bulk price of $7/$5 of the A10/A13 varieties. (Note that at least threeA30/A31 based tablet designs have already been leaked by the Chinese site IMP3.net: that of 普耐尔Ployer, that of 艾蔻ICOO, and the CT972-Q tablet from 七彩虹Colorfly.) Given the market leadership position taken by the A10/A13 in their very first year (as of Nov 20 estimate):

the newA30A20/A31 products will have a similar success story of their own in 2013, i.e. sales of tens of millions of unit in addition to the continued success of A10/A13. Mid-yearA30/A31 tablet prices of the 7-inch IPS varieties will be around $100 again as it is now for A10/A13 tablets of similar kind. The Chinese SoC houses competing with Allwinner (Rockchip etc. – see the above chart) will adjust their products to that in the same way as they did in 2012. - My estimation is that there could be at least 50 million Allwinner Axx SoCs sold in 2013, and their number could reach as high as 100 million. Homeland competitors could deliver another 40 to 80 million units. This will pose a very significant challenge to the current leaders of the global market. With super cheap but powerful and high-quality Chinese SoCs as much as 100 million tablet products from PRC may come just to the 2013 external market at prices ranging from $50 to $150. This will immediately effect not only the opportunities and the business performance of the current branded tablet vendors, but most importantly the market situation for such core technology vendors as Microsoft, Intel and Qualcomm in a fundamental way.

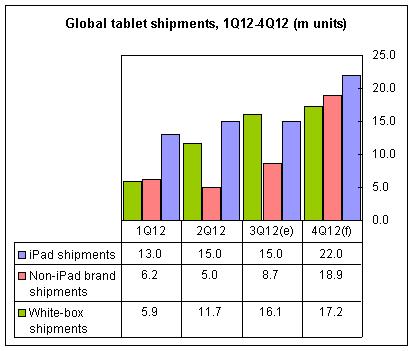

To understand the impact here is a chart from the same DIGITIMES Research (see Digitimes Research: White-box tablet shipments to surpass 50 million units in 2012 [DIGITIMES, Nov 13, 2012]):

From this and Digitimes Research: Global tablet shipments to surpass that of notebooks in 2013 [DIGITIMES Research, Nov 19, 2012] we may come to the following table:

| (million units) | 2012 | 2013 |

| iPad shipments | 80.0 | 89.0 [84.0] |

| Non-iPad brand shipments | 38.8 | 51.0 [46.0] |

| White-box shipments | 50.9 | 70.0 [100.0] |

| TABLET SHIPMENTS | 169.7 | 210.0 [230.0] |

| Notebook shipments | 192.0 | 189.0 [184.0] |

The white-box shipments are exactly those tablet products mentioned above as coming from PRC (People’s Republic of China). My estimate of that volume is even higher by 30 million units with which the white-box shipments will be 100 million units in 2013.

The overall outcome will be somewhere between two extremes:

- When price elasticity will be able to help in selling those additional 30 million white-box units in the cheapo $50…$150 range, then the other numbers won’t be affected.

- When such cheapo tablet prices of additional 30 million white-box units will help 100% replacement for other categories in the table only, then those 30 million units will decrease the numbers in other categories.

When one is taking a kind of middle road then may assume 100 million white-box shipments (30 million units more) with 84 million iPads, 46 million non-iPad brand tablets and 184 million notebooks. These are the numbers I put into square brackets in the table.

This little exercise is showing that with just 43% increase in the shipment of white-box tablets iPad shipment growth will be just 5% vs. 11%, non-iPad brand shipments will grow by only 19% vs. 31%, and notebook shipments will decline by 4.2% vs. 1.6%.

The more dramatic effect, however, is that while overall tablet shipments will grow by 36%, notebook shipments will decline by 4.2%. And these will be extremely bad news for both Microsoft and Intel, especially in terms of the strategic stance of the Windows 8 against Android (as the white-box tablet shipments will be all Android, and for Windows 8 year 2013 will be its 1st on the market with meaning the new version is not able to sustain even the yearly unit volume of the Windows against the onslaught of the much more affordable Android tablets).

If this scenario will happen on the market, or even a scenario which is worse than that from Windows point of view, then for both Microsoft and Intel it will mean that they should give up their premium pricing strategy, i.e.

– introduce sub $50 (or even deeply sub $50) per unit fees (versions) for large volumes both in Windows 8 licenses and Intel SoCs instead of the current dominance of the ~$100 unit fees;

– and introduce that extremely fast.

But, do not forget, the Chinese SoC invasion of the global client device market will be stronger again in 2014, so even that reaction on Microsoft and Intel side could already be too late.

That is at stake in the upcoming very first year, and to record all the events happening in this particular battle is the reason for introducing this blog.

Pingback: $40 entry-level Allwinner tablets–now for the 220 million students Aakash project in India « USD 99 Allwinner

Pingback: Allwinner interest in 2013 | USD 99 Allwinner

Pingback: Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in

Pingback: Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in

Pingback: Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in

Pingback: Intel CTE initiative: Bay Trail-Entry V0 (Z3735E and Z3735D) SoCs are shipping next week in $129 Onda (昂达) V819i Android tablets—Bay Trail-Entry V2.1 (Z3735G and Z3735F) SoCs might ship in $60+ Windows 8.1 tablets from Emdoor Digital (亿道) in